A clear, source-backed guide for artists, galleries and curators selling art in the United Arab Emirates.

TL;DR (Quick answers)

-

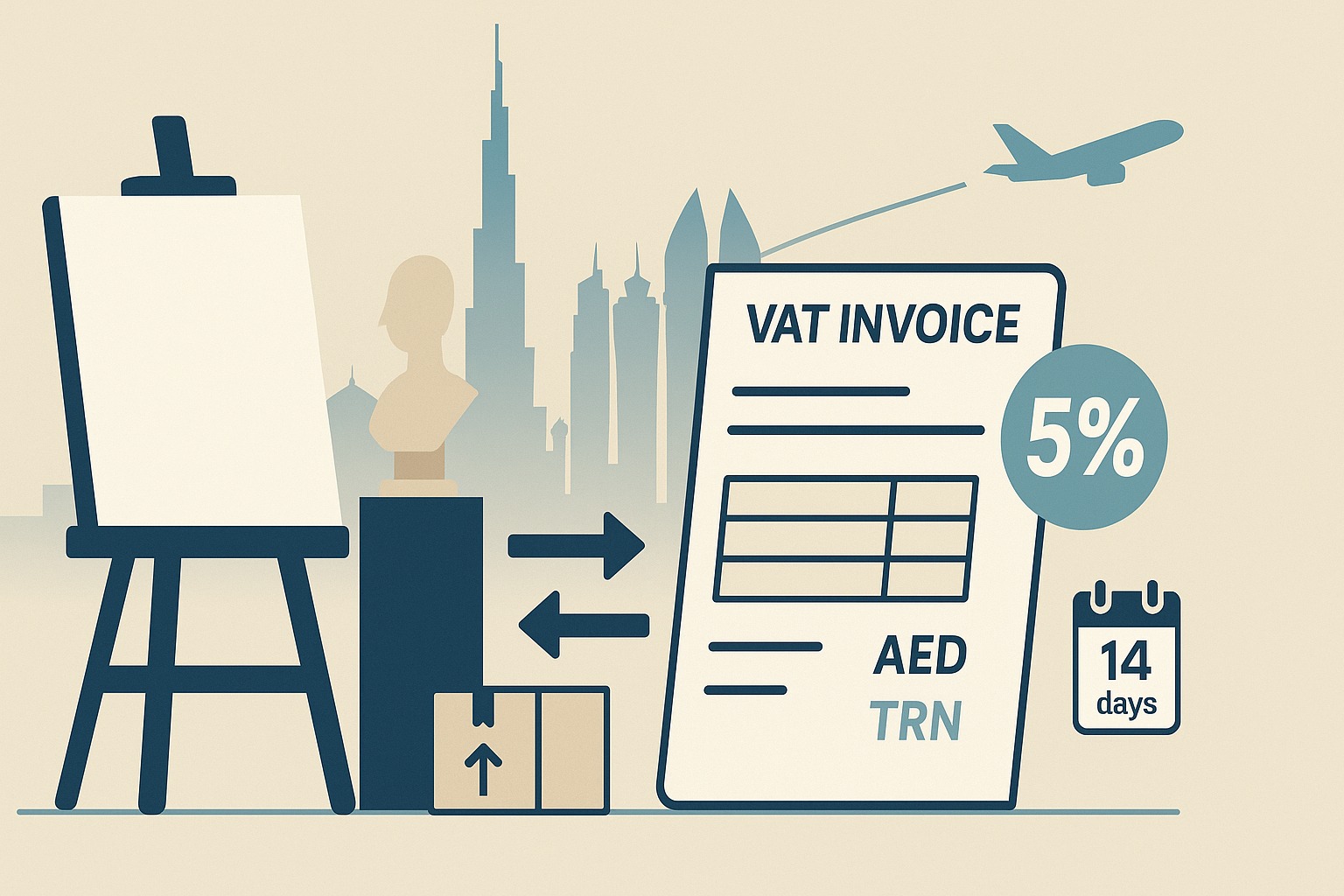

VAT rate: Standard 5% on most domestic art sales and services. UAE Ministry of Finance

-

Must register for VAT: When your taxable turnover hits AED 375,000 in a rolling 12 months (or you expect to in the next 30 days). You may register voluntarily from AED 187,500. Non-resident sellers making taxable supplies in the UAE must register regardless of threshold. UAE Ministry of FinanceFTA UAE

-

Issue invoices: Within 14 calendar days of the date of supply; simplified invoices are allowed in specific cases (see below). FTA UAE

-

Exports of art (goods): 0% VAT if the work is exported from the UAE within 90 days with proper customs evidence. FTA UAE

-

Services to overseas clients (e.g., commissions/licensing): Can be 0% if strict “export of services” conditions are met. FTA UAE

1) Who has to register – and when?

Resident artists/galleries (UAE-based):

Register mandatorily once your taxable supplies + imports exceed AED 375,000 in the past 12 months or are expected to in the next 30 days. You can register voluntarily from AED 187,500 (useful if you want to reclaim input VAT). UAE Ministry of Finance

Non-resident artists/galleries (e.g., at a UAE art fair):

If you make taxable supplies in the UAE and there is no other person obligated to account for the VAT, you must register—no threshold applies. FTA UAE

Late registration penalty: AED 10,000 administrative penalty for failing to submit a VAT registration application on time (Cabinet Decision No. 49 of 2021). FTA UAE

2) What to charge on common art transactions

Domestic UAE sales (goods)

-

Sell a painting/sculpture to a UAE buyer (delivery/collection in the UAE): Charge 5% VAT. UAE Ministry of Finance

Sales at art fairs in the UAE

-

Resident or non-resident selling from a booth in Dubai/Abu Dhabi/Sharjah: typically 5% VAT on sales completed in the UAE. Non-residents must be registered (see above). FTA UAE

Online sales shipped from the UAE

-

Ship to a UAE address: 5% VAT. UAE Ministry of Finance

-

Ship to an overseas address: 0% VAT if the artwork is exported within 90 days and you keep official/commercial export evidence (e.g., customs export declaration + airwaybill). Otherwise the supply becomes taxable at 5%. FTA UAE

Services (commissions, design, licensing, curation)

-

To a UAE client: generally 5% VAT. UAE Ministry of Finance

-

To a client outside the UAE: 0% VAT if the export-of-services conditions are met (recipient has no place of residence in an Implementing State, is outside the UAE when services are performed, and the service is not directly connected with UAE real estate or movable property in the UAE). FTA UAE

Tourists buying art in the UAE (retail)

-

If you’re enrolled in the Tourist Refund Scheme, eligible tourists can reclaim the VAT at departure—you still charge 5% at the till, but Planet/FTA refund the tourist later. (Handy for artist-run shops and galleries with retail sales.) FTA UAEUAE Government Portal

Profit Margin Scheme (secondary market dealers)

-

UAE VAT allows a profit-margin scheme for second-hand goods, antiques (50+ years), and collectors’ items—VAT is charged on your margin, not the full selling price, when conditions are met (e.g., bought from a non-registrant or VAT not recovered on purchase). Original new works by the artist are not “second-hand” and typically don’t qualify. FTA UAE

3) Invoicing rules artists actually need

When to issue:

A Tax Invoice must be issued within 14 calendar days from the date of supply. FTA UAE

Full vs. simplified invoices (Article 59):

-

Full Tax Invoice – required for B2B supplies and where consideration exceeds AED 10,000; includes supplier & customer details (incl. TRNs where applicable), dates, description, unit amounts, VAT rate/amount, etc. FTA UAE

-

Simplified Tax Invoice – allowed when the recipient is not VAT-registered or when the recipient is registered but the consideration ≤ AED 10,000; shows fewer fields (e.g., supplier TRN, date, description, total incl. VAT, VAT amount). Not allowed where reverse charge applies. FTA UAE+1

Reverse charge & “concerned services” (imports of services):

If you buy services from overseas (e.g., a non-UAE freelancer retouches your images) and the place of supply is in the UAE, you typically self-account for VAT under the reverse-charge. Public Clarification VATP044 (May 26, 2025) confirms you’re not required to self-invoice if you keep the overseas supplier’s invoice and account for VAT correctly. FTA UAE

4) Bringing art into the UAE (imports)

-

Import VAT (usually 5%) is due on the customs value when artworks enter the UAE. Registered businesses typically account via the FTA/Customs process (VAT301 / EmaraTax workflows), while non-registered importers pay at import. FTA UAE

5) Designated Zones (free-zone warehousing)

Some free zones are “Designated Zones” for VAT. Goods kept/moved within these zones can be outside UAE VAT’s scope (services remain taxable). If you warehouse art in a Designated Zone, check the specific zone’s rules and whether goods are “consumed” there. FTA UAE

6) Can I recover VAT on my costs?

-

Yes, if you’re VAT-registered and the costs relate to taxable (5% or zero-rated) activities—e.g., canvases, framing, studio rent, local transport of artworks. (General principle of input VAT recovery.) UAE Ministry of Finance

-

Blocked/limited recovery applies to certain expenses—e.g., many entertainment costs—and you must apportion if you have both taxable and exempt activities. See the Executive Regulations (Articles 53 & 55) and the FTA input-tax apportionment guide. FTA UAE

7) Three real-world artist scenarios

-

UAE artist sells a painting to a Dubai collector (hand-over in Dubai).

Charge 5%, issue a full Tax Invoice within 14 days. UAE Ministry of FinanceFTA UAE -

Berlin artist exhibits at an Abu Dhabi fair and sells works on site.

They’re making taxable supplies in the UAE; unless a UAE gallery acts as principal accounting for VAT, the artist must register and charge 5%. FTA UAE -

Sharjah artist ships a sculpture to a museum in Paris.

If the piece is exported within 90 days and the artist keeps customs + shipping evidence, the sale can be zero-rated. FTA UAE

8) Compliance checklist for artists & galleries

-

Register once you cross AED 375,000 (or voluntarily at AED 187,500). Non-residents selling in the UAE: register. UAE Ministry of FinanceFTA UAE

-

Charge 5% on domestic supplies; consider 0% for qualifying exports of goods/services. UAE Ministry of FinanceFTA UAE+1

-

Invoice within 14 days; use simplified invoices correctly (≤ AED 10,000 or to non-registrants; avoid for reverse-charge cases). FTA UAE+2FTA UAE+2

-

If retailing to visitors, consider the Tourist Refund Scheme (Planet). FTA UAE

-

If you import artworks, follow the VAT301/EmaraTax process. FTA UAE

-

Keep robust records; late registration can cost AED 10,000. FTA UAE

FAQs (artist-focused)

What counts toward the VAT registration threshold?

Your taxable supplies (5% and zero-rated—exports count) and imports in a rolling 12 months. UAE Ministry of Finance

Can I sell on the Profit Margin Scheme?

Only for eligible second-hand goods, antiques (50+ years), and collectors’ items, when conditions are met. New original works by the artist don’t qualify. FTA UAE

Do I have to self-invoice on imported services?

You must reverse-charge where applicable, but VATP044 clarifies a self-invoice isn’t required if you retain the overseas supplier’s invoice and account for VAT correctly. FTA UAE

Sources (primary/official)

-

UAE Ministry of Finance – VAT overview (rate 5%, thresholds, zero-rated categories). UAE Ministry of Finance

-

FTA – VAT registration (resident & non-resident rules; thresholds). FTA UAE

-

VAT Decree-Law (Article 67) – 14-day invoicing rule. FTA UAE

-

Executive Regulations (Oct 4, 2024) – exports of goods (90 days/evidence), export of services conditions, profit-margin scheme. FTA UAE+1

-

FTA Public Clarification VATP044 (May 26, 2025) – reverse charge / concerned services. FTA UAE

-

FTA/Planet – Tourist VAT Refund Scheme. FTA UAEUAE Government Portal

-

Cabinet Decision No. 49 of 2021 – administrative penalties (AED 10,000 late registration). FTA UAE

Disclaimer

This guide is for general information. It was prepared with care and the best intentions to help artists and galleries. Laws and guidance can change, and details depend on your exact facts. The Art Fair Guy does not accept any liability for errors or for actions taken based on this content. Before you make sales, issue invoices, register for VAT, or file returns, confirm the current rules with the UAE Federal Tax Authority or other local authorities, and seek advice from a qualified tax adviser.